PCI DSS Service Provider for Providing Security to Your Business

PCI DSS Service Provider

With the advancement in science and technology, we have today’s age of the digital world. We can buy or book anything at any moment just with a click of a button. With this advancement, making payments using credit or debit cards has also been easy. This has also given rise to an increase in the number of frauds or breaches used to mishandling the cardholder data.

Need to have PCI DSS Service Provider:

For any business big or small, each service provider has not started using the option for making payment transactions using cards. Thus any company or business who involves in storage, usage, transmission, or processing the cardholder details is considered a potent service provider. The customer before making any payment to any service provider should check if it is a PCI DSS Service Provider as they are compliant with the PCI security standards.

Goals of PCI DSS Service Provider:

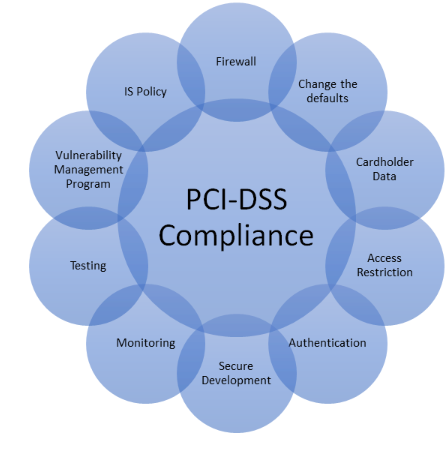

The easiest way to find if the service provider is PCI compliant is by checking their PCI DSS compliance status. The goals of every service provider to maintain their internal control include:

To create and maintain the secured network.

Protection of the cardholder data during storage, processing, and encrypted transmission through a public network.

Undertaking program for vulnerability management for the protection of software, applications, and systems.

Having strong control over the access to prevent unauthorized access to the cardholder data.

Continuous monitoring of the secured network and tracking the cardholder data.

Carrying out regular tests to check the working of the security system.

Development and maintenance of information security policy.

The service provider should complete and submit the annual report along with the 4 SAQs required by PCI DSS.

Checklist for selecting the PCI DSS Service Provider

Certain points need to be checked and enquired about before selecting the PCI DSS Service Provider. These checklists for selecting the PCI DSS Service Provider include:

Documentation: The service provider should have all the necessary documents that mention the service provider being PCI compliant.

Experience from a data breach: One should do the background check on the service provider to understand how many data breaches have they experienced and how they have handled these data breach cases. Also need to check what precautionary steps are taken to prevent sent breaches.

Incident response plan: One needs to check the service provider’s Incident Response (IR) plan that includes written details of steps followed when they identify the data breach.

Background check on the employees: The service provider needs to carry out an in-depth background check of the employees involved in the storage, processing, handling, and transmission of the cardholder data.

Recommendations and complaints: before selecting any service provider, it is better to check for the recommendations for the service provider or complaints against them. This will help to get the details like trustworthiness and reliability of their work. This gives velar transparency to understand the functioning of the service provider.

Each of these service providers should be a PCI DSS Service Provider. This assures that the money of the customer is in safe hands.